Digital Assets Weekly Newsletter for May 5, 2025

Strategy doubles its bitcoin treasury plan to $84B while stablecoin legislation and adoption signal transformative era for digital assets.

Bitcoin

Saylor’s Strategy Expands To $84B Raise For Bitcoin Treasury

Strategy (MSTR) announced an expansion of its bitcoin acquisition plan, from $42B to $84B through equity and debt issuance, aiming to accelerate bitcoin accumulation

Strategy unveiled its "42/42 Plan" doubling its capital-raising goal to $84B ($42B each via equity and fixed income) through 2027, expanding the original "21/21 Plan" to fund Bitcoin purchases, with $15B remaining from the initial target, per the announcement

The company reported a Q1 2025 net loss of $4.2B, driven by $5.9B in unrealized bitcoin losses under FASB’s new fair value accounting rules, while holding over 550,000 BTC, making it the largest corporate bitcoin holder

Strategy plans to maintain a 20%-30% leverage ratio (debt and preferred stock to Bitcoin holdings), using new financial instruments like STRK and STRF perpetual preferred stock to attract diverse investors

Wall Street analysts praised Strategy’s first-mover advantage and liquidity, noting it has already raised $28.3 billion and achieved 90% of its original BTC Yield target in four months

Michael Saylor highlighted Bitcoin’s legitimization through corporate adoption, while CEO Phong Li emphasized accretive equity raises at over 1x mNAV, with Strategy’s stock up 30% YTD to $381.60

During the earnings call, Saylor highlighted multiple new bitcoin-focused financial metrics and KPIs, such as BTC Yield, BTC Gain, and BTC $ Gain

Strategy Bitcoin Holdings. Source: TheBlock Research

Strategy Playbook Followers Accelerate

Metaplanet, a Strategy follower corporation based in Japan, issued $24.7M in zero-interest bonds to purchase more bitcoin, bringing its total holdings to 5,000 BTC, half of its 2025 goal of 10,000 BTC

Metaplanet also announced the establishment of a U.S. subsidiary, Metaplanet Treasury Corp., in Miami, Florida, aiming to raise $250M to accelerate its bitcoin treasury strategy, with an initial capital of $10M

The U.S. subsidiary will likely enhance Metaplanet’s access to institutional liquidity pools and accelerate its bitcoin acquisition efficiency

Metaplanet’s stock rose 10.4% ton the news and now ranks among the top 10 corporate bitcoin holders globally, alongside Strategy, Square, and Tesla

$330M Social Engineering Theft Of Elderly Citizen’s Bitcoin Holdings

An elderly U.S. citizen lost 3,520 BTC ($330.7M) in a social engineering scam, marking the fifth-largest crypto heist in history

The attacker used advanced social engineering tactics to gain wallet access, exploiting trust rather than technical vulnerabilities

Stolen BTC was laundered through over 300 wallets and multiple instant exchanges using peel chain transaction methods, with the majority converted to Monero (XMR), causing a 50% XMR price spike due to low liquidity

Blockchain investigator ZachXBT flagged the suspicious transfer and confirmed the victim’s identity, noting the wallet had been dormant since 2017

A key issue to address in combatting crypto thefts is the speed of action on the enforcement side, as hackers move stolen funds in minutes with automation while manual tracing and court-ordered fund freezes usually take days or weeks

Blockchains

Solana Policy Institute Asks SEC To Allow Equities Onchain

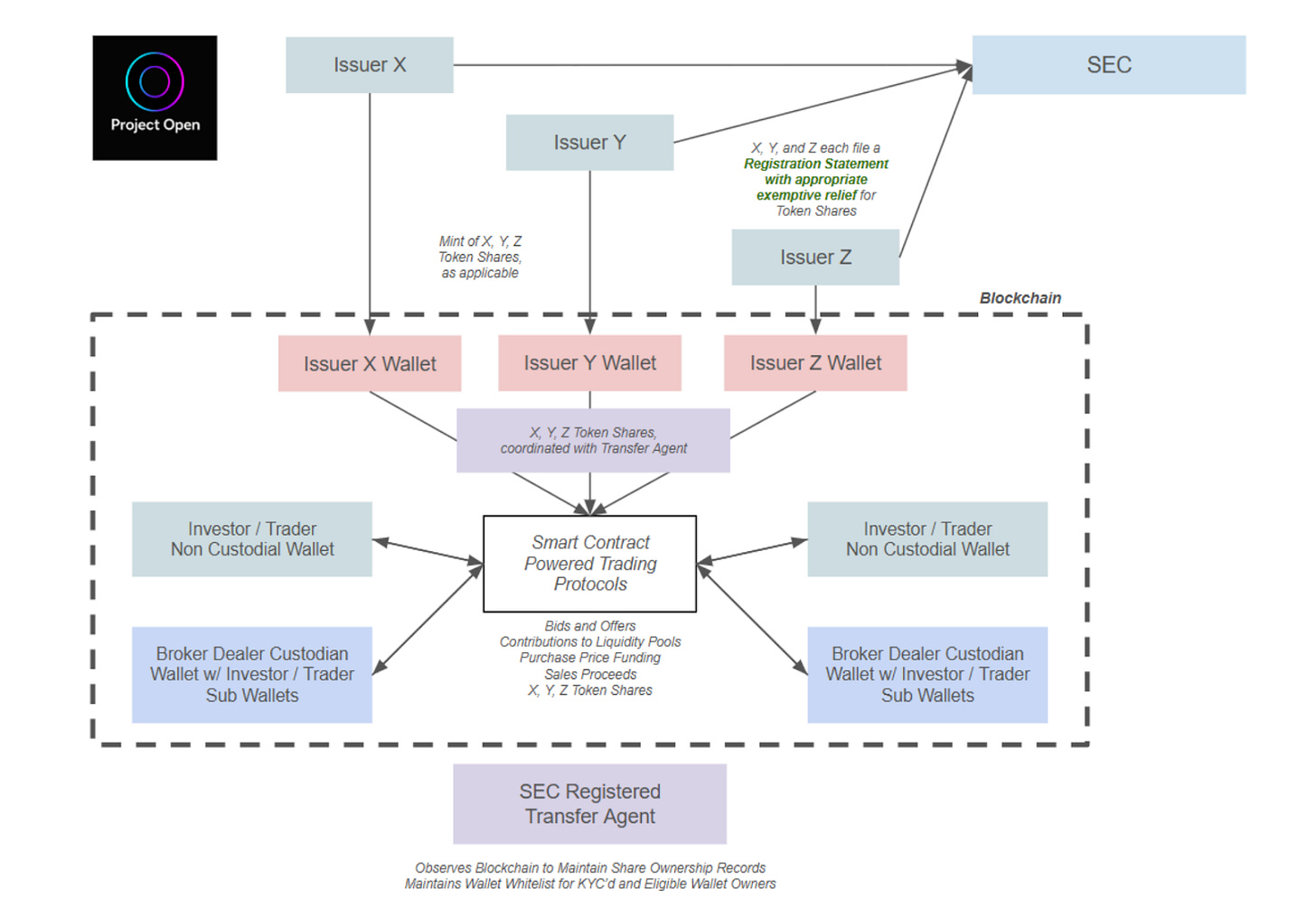

The Solana Policy Institute, with Superstate Inc., Lowenstein Sandler LLP, and Orca Creative, proposed Project Open to the SEC’s Crypto Task Force, aiming to tokenize equity securities on blockchains like Solana for 24/7 trading, instant settlements, and reduced costs

Project Open could use Solana’s high-speed blockchain for issuing “Token Shares” via smart contracts, enabling instantaneous wallet-to-wallet settlement without clearing delays, using automated market makers (AMMs) for liquidity, token-extensions for compliance controls, and allowing trades in stablecoins or other digital assets, bypassing traditional Reg NMS “regular way” settlement

The proposed 18-month pilot limits the issuer cohort, requiring SEC registration statements and periodic reporting under the ‘34 Act; issuers must use blockchain-based transfer agents with “super administrative authority” to manage errors or hacks, and investors need whitelisted wallets with KYC and educational onboarding, while blockchains are exempt from SEC registration, per the filing

Notably, the proposal would make blockchain data the transfer agent’s primary system of record. To date, transfer agents have used offchain database records as the primary system of record

Architecture for Token Shares. Source: Solana Policy Institute

Market Maker Pump And Dump Scandal Tarnishes Movement Blockchain Ecosystem

Movement Labs confirmed the suspension of co-founder Rushi Manche following a market-making scandal involving Movement Foundation and Rentech, which allegedly sold 66 million MOVE tokens for a $38M profit in a pump-and-dump scheme

The scandal stems from a December 2024 mainnet beta launch, where Rentech, misrepresented as another company’s subsidiary, gained control of 5% of the MOVE token supply

An agreement allowed Rentech to borrow tokens and liquidate them if the MOVE token’s fully diluted value (FDV) exceeded $5B. Rentech would then split 50% of profits with Movement Foundation, raising pump-and-dump concerns

A third-party review by Groom Lake is ongoing to investigate the market maker irregularities, with Movement Labs severing ties with Rentech and establishing a $38M “USDT Strategic Reserve” to restore liquidity to the MOVE token market

Coinbase announced the suspension of MOVE token trading on May 15, 2025, placing order books in limit-only mode, citing failure to meet listing standards, leading to a 20% price drop of the MOVE token

The Movement scandal highlights many of the potential market structure issues to be sorted out by industry and potentially via future regulation, such as relationships between project Labs and Foundation entities, market maker agreement disclosures, and detailed token ownership disclosures

Dogecoin Joins The Crypto Operating Company Asset Mix

Coeptis Therapeutics announced a merger with Z Squared, a Dogecoin miner, spinning off its biopharma operations to focus on building the largest publicly traded Dogecoin mining operation in the U.S.

The merger includes 9,000 U.S.-based Dogecoin mining machines, with Z Squared’s leadership (CEO David Halabu, COO Michelle Burke) taking over, while Coeptis’ biopharma research continues under a private entity, retaining shareholder exposure to both

Dogecoin, a proof-of-work blockchain with a ~$25B market cap native asset in DOGE, ranks among the top 10 crypto assets, and has pending ETP applications from Bitwise, Grayscale, 21Shares, and Osprey, with decisions expected by mid-May to late 2025

Coeptis’ stock (COEP) dropped nearly 40% post-announcement, likely reflecting market skepticism on the Dogecoin-focused operating company

Solana-focused operating companies such as SOL Strategies and DeFi Development Corp, both saw their stock prices increase following announcements of pivots to Solana-focused operations

Stablecoins

Visa And Mastercard Launch Stablecoin-Powered Products

Visa and Bridge (a Stripe company) announced a new stablecoin-linked Visa card product, enabling fintech developers to issue cards via a single API, allowing cardholders to spend stablecoin balances at 150 million+ Visa-accepting merchants, starting in Latin America (Argentina, Colombia, Ecuador, Mexico, Peru, Chile)

Mastercard simultaneously launched global end-to-end stablecoin payment capabilities, partnering with firms like MetaMask, Kraken, OKX, Nuvei, and Circle to enable stablecoin spending, merchant settlements in USDC, and onchain remittances via the Mastercard Crypto Credential and Multi-Token Network (MTN)

Bridge facilitates real-time conversion of stablecoins to fiat for merchants, working with Lead Bank, while Mastercard’s MTN connects traditional deposit accounts to digital asset use cases, with partners like J.P. Morgan and Standard Chartered

The initiatives reflect stablecoins’ growing mainstream adoption, addressing demand in regions like Latin America for value storage and payments

Visa and Mastercard’s stablecoin integrations highlight the future of payments is likely powered by backend stablecoin tokens and blockchain networks, with firms like Visa and Mastercard providing familiar front-ends and user experience flows

Ripple Offers To Buy Circle, Circle Declines As Offer “Too Low”

Ripple reportedly offered $4B to $5B to acquire Circle, the issuer of USDC, in a bid rejected as too low less than 30 days after Circle’s U.S. IPO filing

If the bid had been successful, Ripple could have gained material influence in the Ethereum, Solana, and Base ecosystems, where USDC is a critical asset

The acquisition attempt follows Ripple’s $1.2B purchase of Hidden Road in April 2025, aimed at scaling XRP Ledger and Ripple USD activity, as it appears Ripple executives are looking to grow through an M&A approach

Ripple’s bid for Circle signals consolidation opportunities in the crypto market as M&A activity has increased since January. Ripple’s bid could also be a response to Circle’s IPO window likely closing due to tariff-induced market uncertainty

Crypto-Native

TRUMP Token Becomes Component Of Corporate Crypto Strategies

Freight Technologies (Fr8Tech) announced a $20M convertible note facility with an institutional investor to purchase Official Trump Tokens (TRUMP), starting with a $1M initial tranche and up to $19M in future drawdowns

Fr8Tech is the first public company to integrate TRUMP into its treasury, following its $8M FET token acquisition, aiming to diversify its digital asset strategy and support “fair, balanced, and free U.S.-Mexico trade,” and signal Fr8Tech’s support for the Trump administration's policies

Fr8Tech’s $20M TRUMP investment highlights a novel use case for meme tokens in corporate treasuries; access to the Trump administration via events such as the dinner for the top 220 TRUMP token holders

Apple Opens iOS Apps To External Payment Methods, Boon For NFT Marketplaces

Following a U.S. District Court ruling on May 1, Apple updated its App Store guidelines, allowing U.S. iOS apps to include external links or buttons for NFT purchases and secondary marketplace transactions, bypassing Apple’s in-app payment system and its 27% fee

The ruling stemmed from Epic Games’ antitrust case, finding Apple violated a 2021 injunction by restricting developers’ ability to direct users to external payment methods, prompting the policy change

Developers can now enable browsing and purchasing of NFTs from secondary marketplaces (e.g., OpenSea, Magic Eden) within iOS apps, previously limited to browsing only due to Apple’s restrictions, leading the industry to predict a “generational golden consumer crypto bull run” due to increased flexibility for crypto-native apps

iOS apps still cannot offer token-based rewards, ICOs, or crypto mining, and in-app purchases (e.g., premium content) must use Apple’s payment system, preserving some control over monetization

TradFi

BlackRock Files To Modernize $150M Money Market Fund Via “DLT Shares”

BlackRock filed with the SEC to create digital shares tracking its $150M BLF Treasury Trust Fund (TTTXX), using blockchain technology to mirror share ownership records while traditional offchain book-entry records will remain the official ownership record

The digital shares will be managed through The Bank of New York Mellon (BNY), which will leverage blockchain to mirror share ownership

This follows BlackRock’s expansion of its BUIDL tokenized fund to multiple blockchains (Ethereum, Solana, etc.).

The filing reflects institutional interest in tokenization, following Fidelity’s pending Ethereum-based OnChain share class and the need to plan for a future where blockchain data is the primary data format for assets

Morgan Stanley and Charles Schwab Say Crypto Trading Is On The Way

Morgan Stanley is planning to launch crypto trading on its E*Trade platform in 2026, starting with BTC and ETH, partnering with established crypto firms to enable direct trading for retail clients

Charles Schwab’s CEO Rick Wurster announced that the firm is “hopeful and likely” to launch spot crypto trading within the next 12 months

The moves follow a pro-crypto regulatory shift under Trump, with Morgan Stanley previously offering crypto ETFs to wealthy clients and Schwab backing various crypto firms, noting Millennials’ high interest in crypto ETPs

Regulatory

U.S. Treasury Releases Detailed Report on Stablecoins

The U.S. Treasury Borrowing Advisory Committee (TBAC) report from April 30, highlighted stablecoins as a new payment mechanism, with issuers holding over $120B in T-bills, potentially driving $900B in incremental demand for U.S. Treasuries by 2030

Stablecoins could grow to $2 trillion by 2030 with market and regulatory breakthroughs, correlating with T-bill demand but potentially at the expense of bank deposits, disrupting traditional banking, per the TBAC analysis

The report notes stablecoins’ impact on monetary policy, with issuers holding assets equivalent to major investors (e.g., USDT as the 15th largest T-bill holder), and potential growth posing risks to bank stability if deposit outflows accelerate, per the findings

Crypto Industry Sends Letters For Updated Staking And Mining Regulatory Treatment

The Crypto Council for Innovation (CCI) and nearly 30 crypto organizations, via the Proof of Stake Alliance (POSA), submitted a letter to the SEC, arguing that staking is a technical process, not a security or investment contract, and should not be regulated as such

The letter highlighted that staking rewards are protocol-defined, not tied to managerial efforts, and thus do not meet the Howey Test for securities; it cites the SEC’s 2024 stance on proof-of-work mining as a precedent, urging the SEC to allow staking in spot Ethereum ETFs

The letter notes that staking as a service (StaaS) arrangements provide “valuable technical services” for network security, not passive investment gains, likely to counter the SEC’s past enforcement actions under Gary Gensler (e.g., Kraken’s $30M settlement in 2023)

The Digital Power Network (DPN) sent a letter to the U.S. Treasury and IRS to end the “unfair double taxation” of Bitcoin miners, arguing that taxing mining rewards as income and again as capital gains upon sale creates an undue burden

DPN highlighted that miners face high operational costs (e.g., electricity, hardware), and double taxation discourages domestic mining, pushing operations overseas, despite Bitcoin mining’s role in energy innovation and grid stability

Howard Lutnick Highlights Bitcoin Mining In U.S.

U.S. Secretary of Commerce Howard Lutnick, a known Bitcoin advocate, signaled a strong pro-Bitcoin stance under the Trump administration in a recent interview with Bitcoin Magazine

Lutnick views Bitcoin as a commodity akin to gold or oil, not a currency, and proposes integrating it into national economic accounts like GDP calculations, potentially via the Bureau of Economic Analysis

Lutnick also highlighted that the Department of Commerce’s investment accelerator aims to streamline regulations and permits for Bitcoin mining firms, fostering large-scale investments

Lutnick envisions Bitcoin miners building private power plants near gas fields or hydroelectric sites, reducing grid reliance and costs, which could significantly boost U.S. mining operations

China’s Yuan Usage Expanding, Push for Chinese CBDC Integration in Cross Border Trading

The People's Bank of China (PBOC) is reportedly leveraging U.S. tariff disruptions to promote the yuan globally, with cross-border yuan payments hitting a record in March 2025, according to a Reuters report

The PBOC is advancing the blockchain-based digital yuan (i.e., Chinese CBDC) for cross-border commodity trades (e.g., oil, gold), aiming to establish a financial architecture independent of Western banks, which could compete with dollar-based stablecoins

In April 2025, PBOC-controlled China UnionPay expanded its payment network to over 30 countries, including QR-code payments in Vietnam and Cambodia, facilitating yuan use for tourists and small businesses

U.S. tariffs under President Trump, including 104% duties on Chinese goods, may have eroded international trust in the dollar, boosting yuan attractiveness and prompting China to strengthen its Cross-Border Interbank Payment System (CIPS)

China's closed capital account still restricts the yuan's global mobility, limiting its ability to rival the dollar or euro, but progress with trading partners like Russia accelerates adoption

ETP Flows

TradFi products saw continued positive inflows for the third straight week, with $2B of inflows last week. Inflows were positive across all crypto asset products, signaling positive investor sentiment broadly for digital assets, not solely the bitcoin narrative as a safe haven asset from tariffs. The past two weeks of inflows have nearly reversed the previous two months of outflows due to trade war uncertainties. Many new ETP products for U.S. investors are likely on the horizon. 21Shares filed for a SUI ETP with the SEC on May 1, aiming to track the price of SUI, the native token of the Sui blockchain, while Canary Capital filed for a staked SEI ETP on the same day, seeking to offer exposure to SEI with staking rewards, held in custody by BitGo and Coinbase. The filings align with a broader wave of altcoin ETP applications (e.g., XRP, Solana), with the SEC yet to approve staking in crypto ETPs.

ETP Funds Flows. Source: Coinshares

ETP Funds Flows. Source: Coinshares

Market Monitoring

Stablecoins, specifically stablecoin legislation, are top of mind for industry and policymakers this week as a final push to get stablecoin legislation done in Congress before Memorial Day is underway. Stablecoins have cemented themselves as one of the killer use cases for blockchain technology, reaching $242B as of May 5, according to DeFiLlama. Projections from CoinDesk suggest the market could double to $400B by the end of 2025, fueled by institutional demand and expanding use cases such as tokenized products offering yield to investors. Stablecoins have entered policymakers’ consciousness via dollar dominance onchain (i.e., exporting dollars in digital token format), and modernization of U.S. debt markets (i.e., stable issuers buying U.S. Treasuries).

Total Supply of Stablecoins. Source: DeFi Llamma

While the market is currently highly concentrated between Tether (USDT) and Circle (USDC), both crypto-native firms such as Maker and Ethena and TradFi firms such as PayPal, Fidelity, and JPMorgan could chip away at Tether and Circle’s dominance as legislation and general adoption of stablecoins and related products grow.

Concentration of Stablecoins by Issuer. Source: Visa

Research suggests a positive correlation between stablecoin market caps, Bitcoin prices, and DEX trading volumes. When Bitcoin's price rises, stablecoin usage increases as traders use them for hedging and trading, because a higher bitcoin price requires more dollars to buy the same amount of bitcoin. Stablecoins are also viewed as the liquidity for crypto, being the dominant asset to pair against other crypto assets in DEX trading pools. For example, USDT/WETH, USDC/WBTC, and USDC/WETH are the largest pools by volume on Uniswap V3 in the last 24 hours.

Largest Trading Pairs by Volume on Uniswap V3. Source: CoinGecko

The GENIUS Act, introduced in February 2025 by Senator Bill Hagerty (R-TN), aims to establish a regulatory framework for payment stablecoins, passing the Senate Banking Committee on March 13 with a bipartisan 18-6 vote. GENIUS seeks to regulate issuers as "permitted payment stablecoin issuers,” potentially under federal or state oversight, providing clarity for the stablecoin industry. However, some Democrats recently pushed back, seeking tighter rules on blockchain transparency and law enforcement impacts, foreshadowing potential debates on the Senate floor in the upcoming weeks as the U.S. aims to take the global lead in one of crypto’s main use cases.

If you are interested in further discussion or deep dives on any of the topics covered this week, you can reach me at liam@glennonlabs.com

I hope you have a great week.

Liam Glennon

This newsletter is for informational purposes only and does not constitute investment advice, financial advice, tax advice, or a recommendation to buy or sell any asset; readers should conduct their own research and consult a qualified financial advisor before making investment decisions.